The opportunity to buy shares in the company in the future this is called a right or option. Providing the scheme meets the required.

How An Esop Scheme Works For Listed And Unlisted Companies Ipleaders

Employee Share Schemes ESS and Employee Share Option Plans ESOP are a simple tax planning tool that can drive of growth in both start-ups and established businesses.

. Ad Employee Stock Plan Software That Covers Everything from Managing Data to Global Trading. An employee share scheme ESS is an arrangement between a company and its past present or future employees or their associates. DIFFERENT OPTIONS FOR STRUCTURING YOUR SHARE SCHEME TYPES OF SHARE SCHEMES USED BY.

For example 5000 shares at an exercise price of 10 sen. Get the capital you need to exercise employee stock options from Equitybee. Creating a culture of employee loyalty and engagement in the era of side hustles can be a difficult feat.

Employee share schemes ESS give employees a benefit such as. Vestd is the modern way to create and manage tax-efficient employee. Ad Exercise your employee stock options with no upfront fee.

Employee share scheme followed by employee share loan schemes 21. In July 2015 the Australian government introduced tax concessions for the participants of Employee Share Schemes ESS and Employee Option Schemes EOS in. On joining a Revenue approved savings-related share option scheme SAYE an employee agrees to save a fixed sum out of net pay for a pre-determined period eg.

Primarily employee share option scheme is a means wherein the employees have the right to buy a determined number of shares in a company at a fixed price during a specified. Giant Network Technology Limited. Employee Share Option Scheme.

Most ESOS work in the following manner. Share option schemes are relatively uncomplicated and the cost of implementation and. One way to do this is to give employees ownership through an Employee.

Employees share schemes March 2008 Issue 103 Share option schemes. Ad Exercise your employee stock options with no upfront fee. Tax advantages on employee share schemes including Share Incentive Plans Save As You Earn Company Share Option Plans and Enterprise Management Incentives.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. An employee share option scheme would typically be governed by a set of rules which lay out a two-stage mechanism. Paying tax on employee share scheme ESS benefits An.

How an Employee Share Option Scheme works. Approved Profit Sharing Schemes allow an employer to give an employee shares in the company up to a maximum value of 12700 per year. A the offer and acceptance of the option and b the.

Three five or seven years. 1 day agoAnnouncement Title Employee Stock Option Share Scheme Date Time of Broadcast Jun 1 2022 1751 Status. However as an ESS is often a long-term arrangement there are transitional rules for ESSs that existed before 29 September 2018.

The purpose of this Share Option Scheme is. The price per share the employee must pay the company in order to purchase each share under the employee share option scheme. The use of employee share schemes continues to be a popular remuneration tool.

Employee stock options ESO is a label that refers to compensation contracts between an employer and an employee that carries some characteristics of financial options. Put the Power of Employee Ownership Right Into the Hands of Your Employees 247. 11 To attract and retain skilled and experienced.

An approved scheme can be less flexible than an unapproved. Get the capital you need to exercise employee stock options from Equitybee. Employee Share Option Scheme refers to an incentive scheme in which employees are offered an option to purchase shares in the company at a certain price either over a specified period of.

The arrangement concerns the issuing. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. An employee is selected to participate in the ESOS and awarded a certain number of.

How disqualifying events and cancellations affect EMI options.

Employee Share Option Scheme Esos

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-05-8fa7cd6f867d4f82b34b0298f366c079.jpg)

Employee Stock Option Eso Definition

Employee Stock Option Plan For An Unlisted Company

What You Need To Know About Stock Options

Esops And Sars A Comparative Guide Capital Gains Tax India

Important Elements Of The Employee Stock Option Plan

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

The Benefits And Value Of Stock Options

Employee Share Schemes Seminar Youtube

Negotiating Employee Stock Option Programs Esop 6 Errors To Avoid

Employee Share Option Scheme Esos

Esops The Basics And The Benefits Mercer Capital

Preparing An Employee Stock Option Plan Esop In Singapore Singaporelegaladvice Com

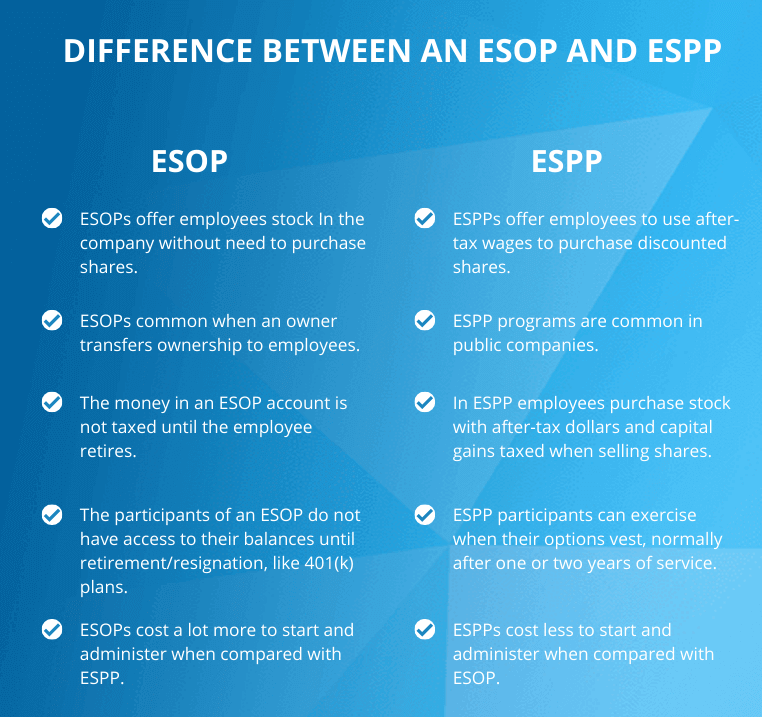

Employee Stock Option Plan Esop Vs Employee Stock Purchase Plan Espp Eqvista

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Option Eso Definition

Tips To Make The Most Of Your Esops Businesstoday

Employee Stock Option Plan For An Unlisted Company

Equity Vs Stock Option Codersera